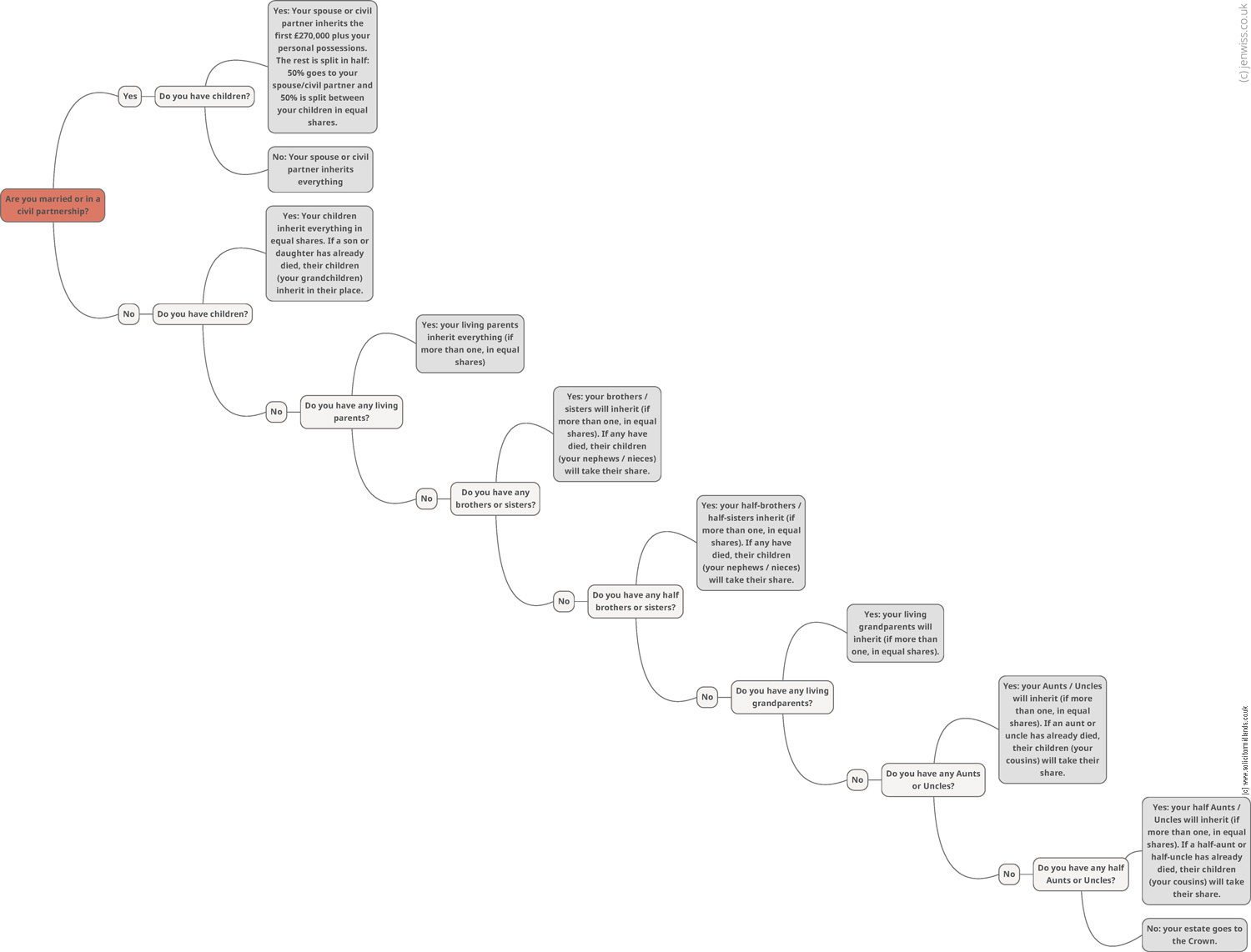

The rules depend on whether you are married / in a civil partnership or not, and whether you have children.

Broadly speaking:

- If you are married or in a civil partnership with no children, your spouse or civil partner gets everything.

- If you are married or in a civil partnership with children, your spouse or civil partner gets your personal possessions and the first £270,000 of your estate. The balance is split 50/50 between (a) your spouse or civil partner and (b) your children in equal shares.

- If you are unmarried with children, your children get everything.

For more scenarios, see the graphic below.

The outcome of the intestacy rules is rarely ideal. Consider this example:

| Example: This example illustrates some of the benefits of making a Will vs. the problems caused by the statutory ‘intestacy’ rules. Sarah and Andrew have been married for 8 years. Sarah has a child from a previous relationship, Crystal (15) who lives with her biological father and does not like Andrew. Andrew has a son from a previous relationship, David (16), who grew up with them. Sarah did not formally adopt David. They also have a child together, Amber (5). They have not made Wills. They owned their house as tenants in common in equal shares, value £650,000, with no mortgage. Sarah also has savings of £20,000. Andrew does not have savings. Sarah dies. Her estate is worth £335,000 (half the value of the house, plus £10,000 savings after debts and expenses have been paid). Under the intestacy rules, Andrew will inherit the first £270,000. According to intestacy rules, the balance of £65,000 will be split in half: £32,500 (50%) to Andrew and £32,500 (50%) between Sarah’s daughter Crystal and Amber (David does not inherit because he has not been adopted by Sarah). Andrew now owns £627,500 of the house. £11,250 is owned by his 5 year old daughter and £11,250 is owned by Sarah’s daughter Crystal, who he does not get on with (the daughters also got the £10,000 cash between them). This will undoubtedly cause conflict when she reaches 18 and would like her inheritance! Further, despite growing up as a child of the family, David has been disinherited by Sarah (he is not entitled to anything under the intestacy rules). Andrew remarries Alice, who has one grown up child, Stephanie (25). Stephanie has a good job and is self-sufficient. Alice does not adopt Amber. Andrew dies a year later. He did not make a Will. Andrew’s estate is worth £627,500 (the house increased in value in the year, but this has been taken up by debts and expenses). Alice inherits the first £270,000. The balance of £357,500 will be split in half: £178,750 (50%) to Alice and £178,750 between David and Amber. Alice now owns £448,750 of the property. The rest is co-owned with Amber, Crystal and David. Alice dies. After debts and expenses, Stephanie inherits £448,750 of the property which she now co-owns with the children. So from our original couple’s estate, who has inherited?

This is unlikely to be what Sarah and Andrew envisaged. Whilst it is likely that the minor children would succeed in bringing a claim against the estate, this would take time and result in additional expense (potentially reducing the value of the estate) and stress. Further, there is no guarantee of the outcome. The above scenario is not far-fetched – remarriages and step children from previous relationships are very common. In fact, without there being step-children, a remarriage can easily cause an entire estate to pass sideways out of the family, disinheriting your own children. |